In the area of AML/CFT, we provide the following services, which can be provided as part of the “Responsable du Contrôle” function:

overview

The Responsable du Contrôle or “RC” as defined in Article 4(1) of the Law of 12 November 2004 on the fight against money laundering and terrorist financing…

- is the day-to-day contact for any escalation of GW/TF related issues from the Principal, the Principal’s Investment Managers and the Distributors.

- reviews the Principal’s AML/CFT policy at least on an annual basis and then presents it for approval at the next scheduled Board of Directors meeting.

- also reviews all other policies and procedures within its conpendency on at least an annual basis and then presents each for approval at the next scheduled meeting of the Board of Directors or Executive Committee, as applicable.

- conducts a risk assessment at least annually. The risk assessment shall include key performance indicators related to politically exposed persons, high-risk investors, sales and investment risks, suspicious activity reports, number of blocked accounts, etc.

- prepares an annual report of the Money Laundering Officer in accordance with Article 42 (6) of CSSF Regulation No. 12-02 of 14 December 2012 on the fight against money laundering and terrorist financing.

- undertakes the response to the “Collective Investment Sector Reporting Tool (CISERO)” of the CSSF to the extent that the respective questions fall within its competence.

- contributes to answering and submitting the annual “AML/CFT Questionnaire” of the CSSF.

- contributes to the response and submission of “AML/CFT Market Entry Forms” of the CSSF.

- contributes to the submission of information related to AML supervisory measures (drafting, submission and management of requests for submission of information related to AML supervisory measures at the explicit initiative of the CSSF).

- ensures that annual AML training is conducted.

reporting

We may provide periodic reports which may include:

- AML/CFT risk analysis to address GW and TF (CSSF 11/529).

- AML/CFT risk assessment, inter alia, in accordance with CSSF 17/650, as amended by CSSF 20/744.

- AML/CFT due diligence on assets (‘asset screening’).

- Name screening against PEPs

- Name check against negative media and negative news

- Name check for restrictive measures (sanctions) - EU

- Name check for restrictive measures (sanctions) - UN

- MdF - enforcement of individual bans or restrictive measures.

- TA - transaction monitoring

- TA - blocked accounts

- CRF - declaration without transactions (SAR or TFAR)

- CRF - declaration with transactions (STR or TFTR)

- CRF - national information request (NRI)

- CRF - response to a request for information - suspect (RIRA)

- CRF - response to a request for information - suspicious transaction (RIRT).

due diligence of the registry and transfer agency

We perform initial and ongoing due diligence:

- The RC conducts (on-site if necessary) due diligence on the Registrar and Transfer Agent using a risk-based approach.

- Following the visit, a report is prepared outlining observations and recommendations. The report is presented to the next scheduled meeting of the Board of Directors and Executive Committee.

your partner for AML/CFT

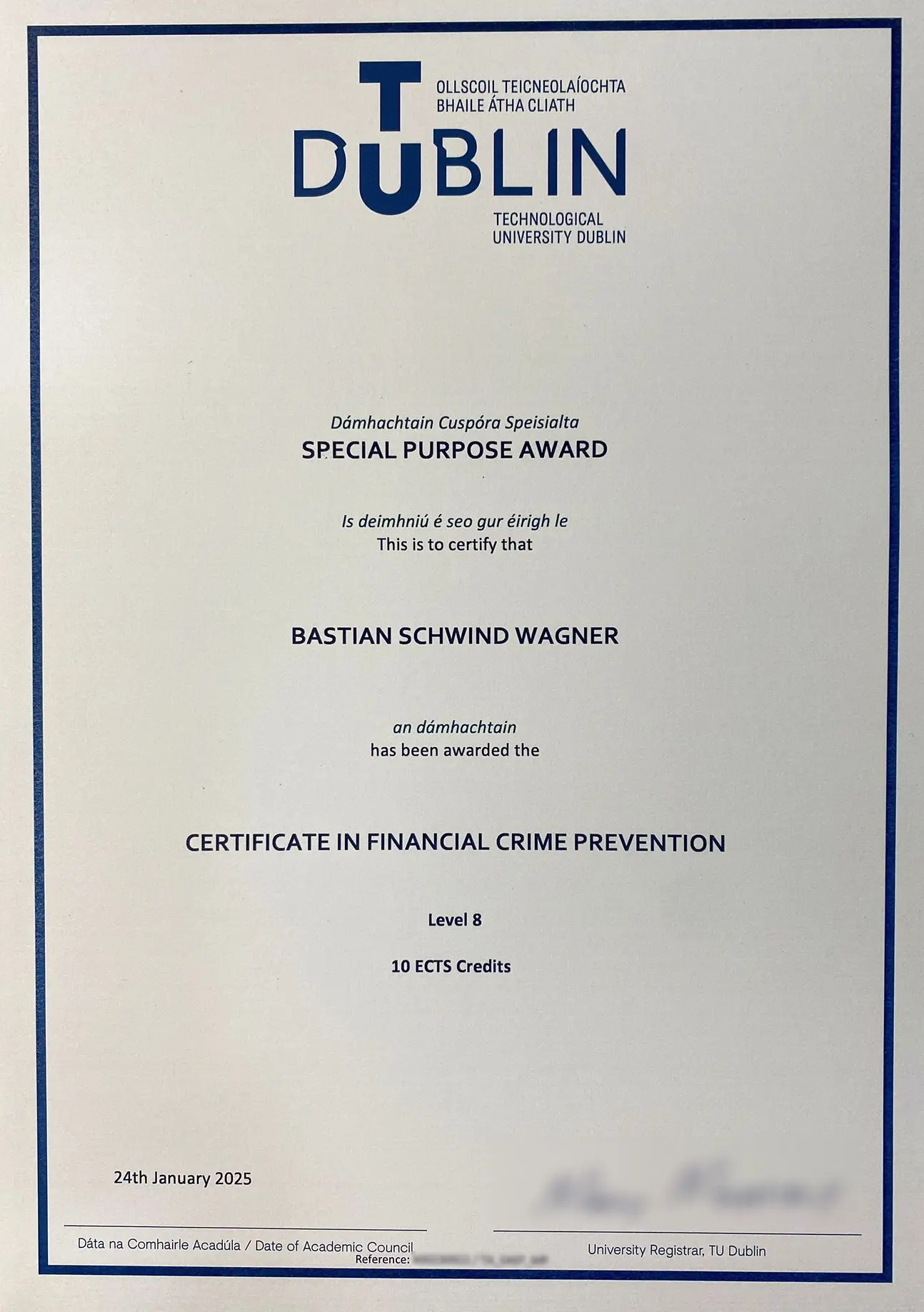

Bastian Schwind-Wagner

Certified Anti-Financial Crime Professional (CAFCP)

Get in touch with us!

Do you have questions or need support in the area of AML/CFT? Contact us today for a non-binding consultation.